Government Grants and Schemes Available to Support

First Home Buyers in Australia (2023)

Government Grants and Schemes Available to Support

First Home Buyers in Australia (2023)

Government wants to make housing more affordable to Australians, so it is supporting first home buyers with many grants, schemes & concessions.

There are few National grants & schemes which are available in all the Australian states and territories and there are few schemes which are only available in specific states or territories. Few schemes stay, and few schemes come and go. For example, “Home Builder Grant” that was introduced in 2020 to boost the economy is not available anymore. In QLD, “Regional home building grant” was available for contracts signed between 4 June 2020 and 31 March 2021.

So, always check if you are eligible for any government support when you are buying your first home. The amount you need to save might reduce significantly if you are eligible for government grants, so it is very important to know if you are eligible for any government support when you are buying your first home.

Based on which state you are buying your first home in, go to that state or ’s official website and check if you are eligible for any government grants.

For up-to-date information about government grants and schemes for first home buyers, please visit below websites.

National Schemes & Grants

1 - First Home Guarantee

About:

The First Home Guarantee (FHBG) is part of the Home Guarantee Scheme (HGS), an Australian Government initiative to support eligible home buyers to buy a home sooner. This scheme is also called the "First Home Loan Deposit Scheme". It is administered by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian Government.

Under the First Home Guarantee, part of an eligible home buyer’s home loan from a Participating Lender is guaranteed by NHFIC. This enables an eligible home buyer to buy a home with as little as 5% deposit without paying Lenders Mortgage Insurance.

For the First Home Guarantee, any Guarantee of a home loan is for up to a maximum amount of 15% of the value of the property (as assessed by the Participating Lender). This Guarantee is not a cash payment or a deposit for a home loan.

Property types

Under the Home Guarantee Scheme, home buyers can buy a residential property, including:

- An existing house, townhouse, or apartment.

- A house and land package.

- Land and a separate contract to build a home.

- An off-the-plan apartment or townhouse.

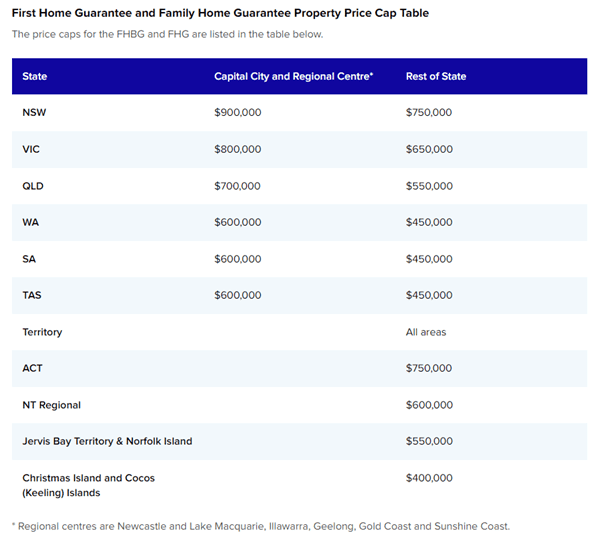

Price Caps

Eligibility:

To apply for the First Home Guarantee, home buyers must be:

- Applying as an individual or 2 joint applicants

- An Australian citizen(s) or permanent resident(s) at the time they enter the loan.

- At least 18 years of age.

- Earning up to $125,000 for individuals or $200,000 for joint applicants, as shown on the Notice of Assessment (issued by the Australian Taxation Office).

- Intending to be owner-occupiers of the purchased property.

- First home buyers or previous homeowners who haven't owned a property in Australia in the past ten years.

Places available: 35,000 in FY 23-24

How to apply:

Home Guarantee Scheme applications can only be made with a Participating Lender or their authorised representative (a mortgage broker). NHFIC does not accept HGS applications or provide personal financial advice.

Resources to know more:

https://www.nhfic.gov.au/support-buy-home/first-home-guarantee

https://www.nhfic.gov.au/participating-lenders

https://www.nhfic.gov.au/support-buy-home/property-price-caps

2 - Family Home Guarantee

About:

The Family Home Guarantee (FHG) is part of the Home Guarantee Scheme (HGS), an Australian Government initiative to support eligible single parents or eligible single legal guardians of at least one dependent to buy a home sooner. It is administered by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian Government.

The FHG aims to support eligible single parents or eligible single legal guardians of at least one dependent to buy a home, whether that single parent or single legal guardian is a first home buyer or a previous homeowner.

Under the FHG, part of an eligible home buyer’s home loan from a Participating Lender is guaranteed by NHFIC. This enables an eligible home buyer to purchase a home with as little as 2% deposit without paying Lenders Mortgage Insurance.

For the FHG, any Guarantee of a home loan is for up to a maximum amount of 18% of the value of the property (as assessed by the Participating Lender). This Guarantee is not a cash payment or a deposit for a home loan.

Property types:

Under the Home Guarantee Scheme, home buyers can buy a residential property, including:

- an existing house, townhouse, or apartment

- a house and land package

- land and a separate contract to build a home.

- an off-the-plan apartment or townhouse.

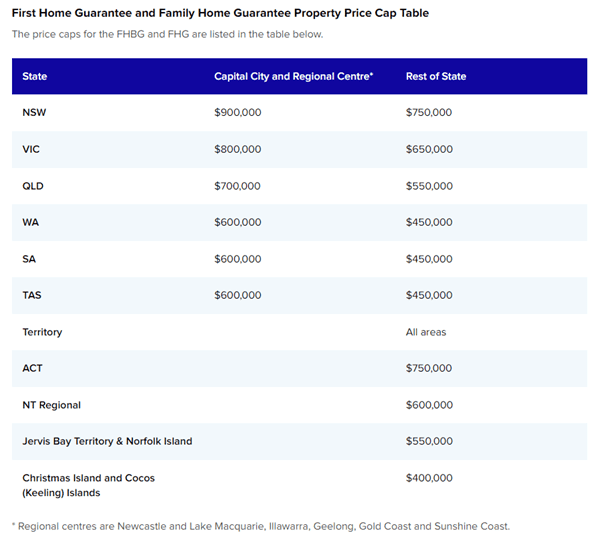

Price Caps:

Eligibility:

To apply for the FHG, home buyers must be:

- Applying as an individual

- A single parent or single legal guardian of at least one dependent (see Eligible Single Parent and Eligible Single Legal Guardian note below) an Australian citizen or permanent resident at the time they enter the loan.

- At least 18 years of age

- Earning no more than $125,000 per year

- Intending to be the owner-occupier of the purchased property

- NOT currently owning property, or upon settlement of the guaranteed property they’re buying, not intending to own a separate property.

Eligible Single Parent and Eligible Single Legal Guardian

To apply for the FHG, home buyers must:

- Be single. A person is considered single if they don’t have a spouse and/or a de facto partner. Note: a person who is separated but not divorced is not considered single

- Have at least one dependent. To have a dependent, they must be the natural parent or adoptive parent or legal guardian of:

- a “dependent child” within the meaning of subsections (2), (3), (4), (5), (6) and (7) of section 5 of the Social Security Act 1991;or

- a person in receipt of a disability support pension within the meaning of the Social Security Act 1991 who lives with you.

- They must show that they are legally responsible (whether alone or jointly with another person) for the day-to-day care, welfare and development of the dependent and the dependent is in their care.

Places available: 5000 places in FY 23-24

How to apply:

Home Guarantee Scheme applications can only be made with a Participating Lender or their authorized representative (a mortgage broker). NHFIC does not accept HGS applications or provide personal financial advice.

Resources to know more :

https://www.nhfic.gov.au/support-buy-home/family-home-guarantee

https://www.nhfic.gov.au/participating-lenders

https://www.nhfic.gov.au/support-buy-home/property-price-caps

3 - Regional First Home Buyer Guarantee

About:

The Regional First Home Buyer Guarantee (RFHBG) is part of the Home Guarantee Scheme (HGS), an Australian Government initiative to support eligible home buyers to buy a home sooner. It is administered by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian Government.

The RFHBG aims to support eligible regional home buyers to buy a home sooner, in a regional area. Under the RFHBG, part of an eligible regional home buyer’s home loan from a Participating Lender is guaranteed by NHFIC. This enables an eligible home buyer to purchase a home with as little as 5% deposit without paying Lenders Mortgage Insurance.

For the RFHBG, any Guarantee of a home loan is for up to a maximum amount of 15% of the value of the property (as assessed by the Participating Lender). This Guarantee is not a cash payment or a deposit for a home loan.

Property types:

Under the Home Guarantee Scheme, home buyers can buy a residential property, including:

- An existing house, townhouse, or apartment.

- A house and land package.

- Land and a separate contract to build a home.

- An off-the-plan apartment or townhouse.

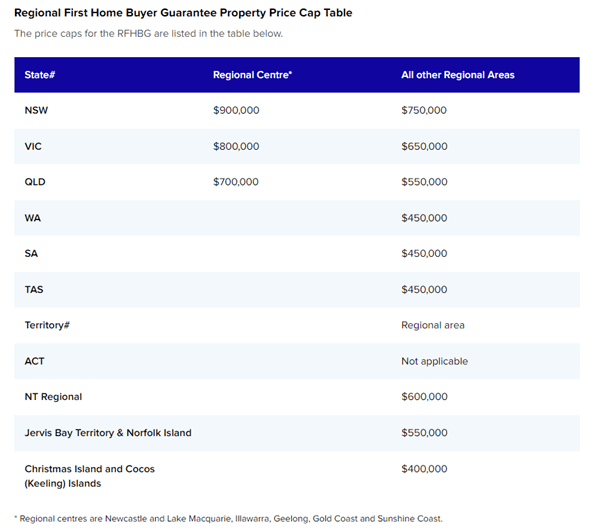

Price Caps:

Eligibility:

To apply for the Regional First Home Buyer Guarantee, home buyers must be:

- Applying as an individual or 2 joint applicants

- An Australian citizen(s) or permanent resident(s) at the time they enter the loan.

- At least 18 years of age.

- Earning up to $125,000 for individuals or $200,000 for joint applicants, as shown on the Notice of Assessment (issued by the Australian Taxation Office).

- Intending to be owner-occupiers of the purchased property.

- First home buyers or previous homeowners who haven't owned a property in Australia in the past ten years.

Places available: 10,000 places in FY 23-24

How to apply:

Home Guarantee Scheme applications can only be made with a Participating Lender or their authorized representative (a mortgage broker). NHFIC does not accept HGS applications or provide personal financial advice.

Resources to know more:

https://www.nhfic.gov.au/support-buy-home/regional-first-home-buyer-guarantee

https://www.nhfic.gov.au/support-buy-home/property-price-caps

https://www.nhfic.gov.au/participating-lenders

About:

The First Home Super Saver (FHSS) scheme can be used by first home buyers to save money inside their super fund to help buy their first home.

FHSS can be used to purchase a new or existing home in Australia.

Couples, siblings, or friends can each access their own eligible FHSS contributions to purchase the same property. If any of you have previously owned a home, it will not stop anyone else who is eligible from applying.

You can only withdraw voluntary contributions which you have made to your super fund. You cannot withdraw employer super contributions.

You can contribute to this fund with your before tax income through salary sacrifice. This should be arranged with your employer.

You can also make voluntary super contributions from your after-tax income.

When you are ready to buy your home, you can withdraw your savings, plus any earnings, and use them towards your deposit. You will be given 12 months’ time to buy your home after you withdraw funds from your super.

How much money can I save in my super for my first home?

For FHSS you can save:

- Up to a maximum of $15,000 in any one financial year.

- Up to a maximum of $50,000 across all years.

- You will also receive an amount of deemed earnings that relate to those contributions.

Eligibility:

- You must be 18 years old or older to request a FHSS determination or a release of amounts under the FHSS scheme (you can start to save before you turn 18)

- You can’t have owned any property in Australia before including land, investment, or commercial property (unless financial hardship applies).

- You can’t have already applied to release money under the FHSS scheme.

- There is no requirement for you to be an Australian citizen, Australian resident, or an Australian resident for taxation purposes.

Places available: There are no limits to the number of applications for this scheme.

How to apply:

You can apply via MyGov.

MyGov -> Super -> Manage Super -> First Home Saver

Resources to know more:

https://www.ato.gov.au/uploadedFiles/Content/SPR/downloads/FHSSessentials_n75457.pdf

You can read the full 33 page report here to know about other grants & schemes here - Read Full Report

Or enter your details below & we can email you the full report.

Disclaimer

We do not warrant that the information contained here is fully complete and shall not be responsible for any errors or omissions. Also, this report provides information only up to the publishing date. Therefore, this report should be used as a guide and not as the ultimate source.

Whilst every effort has been made to make this report as complete and accurate as possible, we will not accept any responsibility or liability for any error caused, whether by negligence or otherwise in the information contained here.