Are you one among many people who were waiting for the property market to crash in 2023 so that you can buy properties at a bargain??

Well, If you are still waiting then may be you have missed the bottom of the property market.

Hello Everyone,

I am Nagaraju Dorasala, I am a property investor and a property buyers’ agent at Investors Delight. In this post let’s go through the Australian property market data to find out if you missed the bottom of the property market or not.

Reserve Bank Of Australia (RBA) started increasing official cash rate from May 2022 and there were 10 interest rate raises by March 2023. The official cash rates went up from 0.1 % in May 2022 to 3.6% by March 2023. Luckily, RBA did not increase the official cash rate in April 2023 as there were signs of inflation slowing down a bit.

Below graph shows the steep interest rate hikes by RBA from May 2022 to March 2023

Below graph shows the impact of interest rate hikes on consumer sentiment. As of April 2023, consumer sentiment is currently at historic low.

If you are thinking that the Australian property market started slowing down only after the RBA started to increase the interest rate in May 2022, then you might be wrong. If you look at the graph below, then you can see that the housing market was already cooling down in April 2022 even before interest rates started to go up. The prices were not falling yet but the rate at which the property prices were increasing was slowing down.

Data Source - CoreLogic

For your information - As we came out of the Covid 19 pandemic caused lock downs in late 2020, From late 2020 to end of 2021, we had a nation Property Boom in Australia where most of the suburbs had double digit price growth.

The RBA started to increase the official cash rate from May 2022 and this would have accelerated the property market slow down and eventually caused down turn by June 2022.

The property market continued its downturn till Sep 2022.

From the graph below we can see a small up tick in the combined capitals property market data which means the downturn was slowing down i.e. price fall was slowing down in Oct 2022.

From the graph below we can see a small up tick in both combined capitals and combined regional property market data which means that downturn was slowing down i.e., price fall was slowing in both capitals and regionals in Nov 2022.

The rate of price fall continued to slow down from Dec 2022 to March 2023.

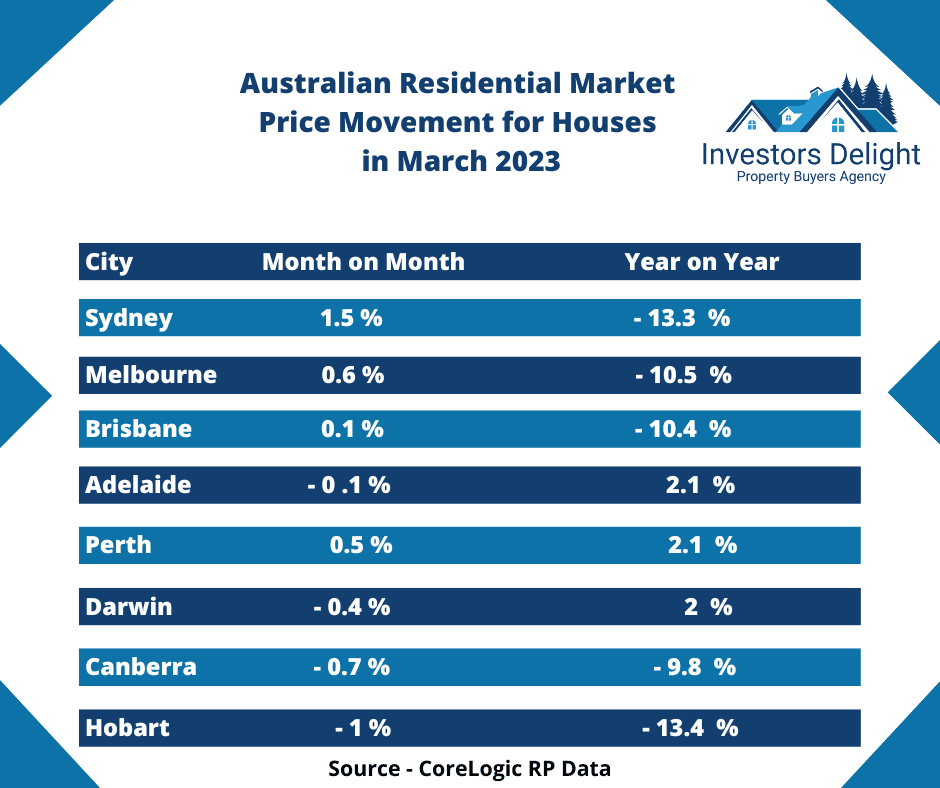

If you look at the below graph, The prices were still falling in March 2023 but the rate at which the prices were falling was very slow and also couple of major capital cities recorded positive month on month growth in March 2023.

If I am not wrong, looks like the bottom of the property market was in March 2023 as we saw positive month on month price growth in major capital cities in this month.

And according to CoreLogic monthly price movement index image show below, Sydney, Melbourne, Brisbane, and Perth had positive month on month price growth in March 2023.

Will this price growth continue? It is difficult to predict the future but if the price growth continues then you definitely missed the bottom of the property market which was in March 2023.

Currently there are low levels of new listings for sale and if the vendors or not in a hurry to sell then this low listing scenario will continue for a while. There are significant delays in construction industry to build new homes, new skilled immigrants expected to come into the country in coming months so all these factors could potentially fuel the price growth to continue.

I wish I had magic powers to predict the future of Australian property market, but I don’t so let’s play a prediction game. Please comment on this post and let me know what your predictions are. Will the price growth continue? If not, why do you think so?